|

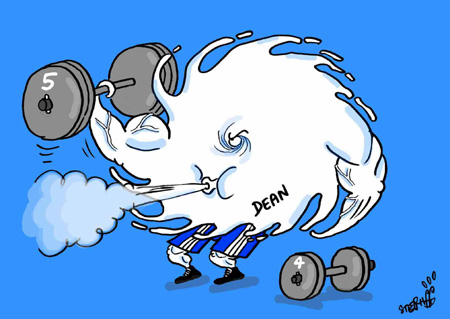

While hurricanes aren't something we have to worry about here in the Pacific Northwest, it is important to remember that natural disasters can cause serious property damage. Don't let yourself be caught with consequences! Review your insurance premiums today.

Story by Insurance Information Institute

The Great New England Hurricane made landfall near Bellport, New York, on September 21, 1938, and killed hundreds of people during an era when storms hit without advance warning.

“Seventy-five years after the Great New England Hurricane, science has advanced to the point where residents and businesses have days to prepare for a severe windstorm that is headed their way,” said Dr. Robert Hartwig, president of the I.I.I. and an economist. “The dilemma for those living and working in the Northeast in 2013 is that places like Long Island, Connecticut, Rhode Island and Massachusetts are much more densely populated, and the site of much more expensively built properties, than was the case in the first half of the 20th century.”

Karen Clark & Company (KCC), a risk modeling firm, released a report this week estimating the Great New England Hurricane would today result in insured claims payouts totaling $35 billion, based on KCC’s reconstruction of the storm’s path and its recreation of the historical meteorological data.

“The Great New England Hurricane, if it occurred in 2013 rather than 1938, would generate insured claim payouts nearly twice those we saw after Sandy, an event for which auto, home and business insurers have to date disbursed $18.75 billion to their policyholders,” Dr. Hartwig said. He added that Sandy became the country’s third most expensive hurricane in history—behind hurricanes Katrina and Andrew.

“With respect to [insured] losses, the worst tracks are those in which the hurricane makes landfall across western Long Island,” the KCC report states. It adds, “Two recent tropical cyclones, Irene (2011) and Floyd (1999) made landfall close to New York City and had they been major hurricanes would have caused losses much greater than any historical Northeast event. Irene’s track in particular would have caused insured losses in excess of $100 billion had it been the intensity of the 1938 event.”

AIR Worldwide found that four of the six U.S. states with the greatest coastal exposure in 2012, as determined by the value of their insured properties, were in the Northeast. New York topped the list, with Massachusetts, New Jersey and Connecticut coming in fourth, fifth and sixth, respectively. Florida and Texas ranked second and third, in that order, on the AIR list.

2013 has so far been relatively quiet, with only one named hurricane, Humberto, having developed in the Atlantic Ocean.

Call Huff Insurance for a quick protection review! Protecting families since 1948.

Tags : insurance, life insurance, vancouver wa, hurricane, disaster insurance

September 22 at 5:43pm · Share September 22 at 5:43pm · Share

|